Estate Planning – The Basics

Your estate — no matter how large or small — is what you’ve accumulated or will accumulate over your lifetime. Simply stated, estate planning is anticipating and making arrangement for your assets in the event you’re incapacitated in your lifetime and after your death. It can be as detailed as you need it to be.

Estate Planning is the only way to ensure your assets are passed to your loved ones without problems, long delays, and high legal fees. And if you have children, planning for their future is essential. If you don’t your assets could go to the state or your wishes for a guardian of your minor children will never bee known,

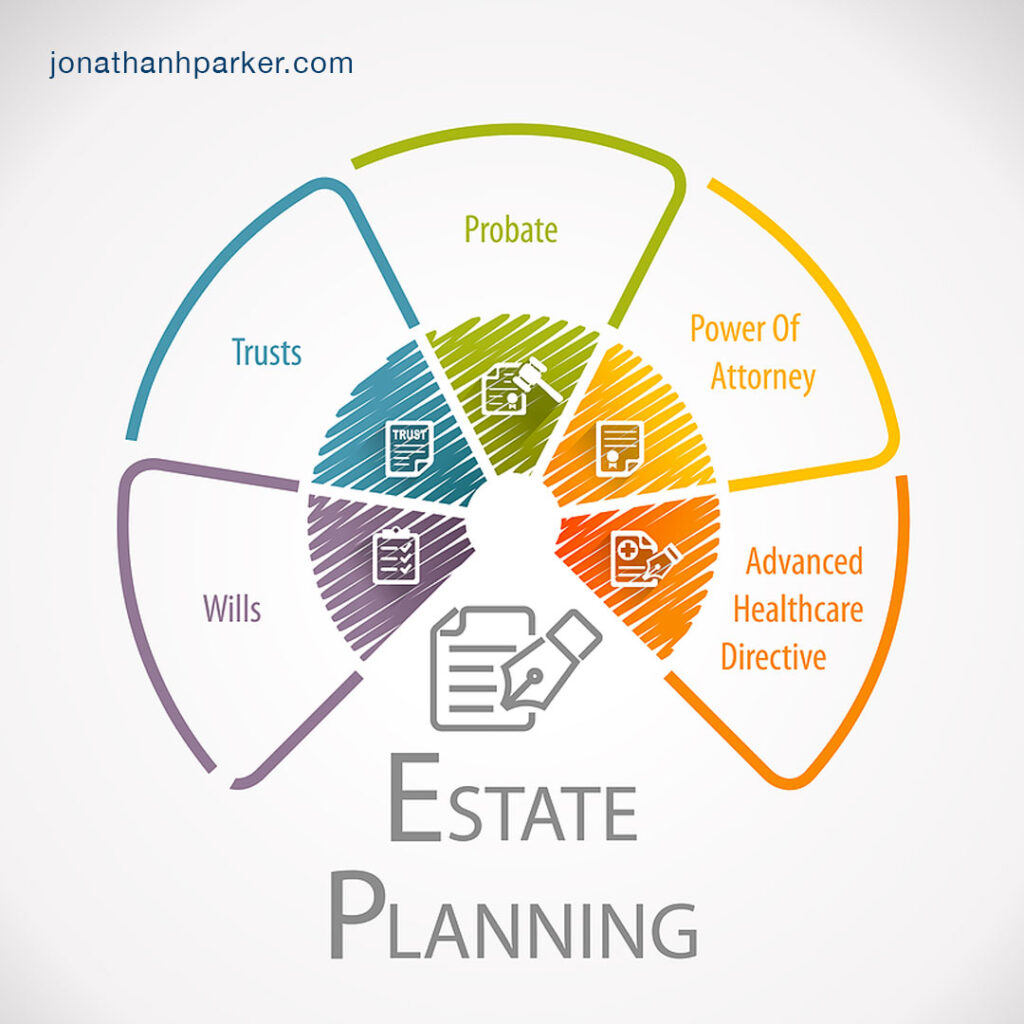

The basic parts of an Estate Plan

Let’s look at the basic components of an estate plan:

- Last Will and Testament: This is a legal document that expresses your wishes about how your property is to be distributed after your death, who you designate to manage the property, and to whom it’s distributed, which can include heirs, organizations, and more.

- Trust: This is an arrangement that may allow you, a third party or trustee to hold assets on behalf of your beneficiar(ies). It is often part of a well-conceived estate plan and can help minimize estate taxes and avoid the necessity of probate and the need to go to court.

- Durable Powers of Attorney (POA): Powers of Attorney allow you designate someone to manage your assets, make legal decisions on your behalf, and work with doctors to make medical decisions while you are living yet unable to handle your affairs or make your own decisions. Some people give their designee their powers of attorney while they are still able to handle their own assets and self yet no longer want to do so; for others, they establish the POA to take effect IF they are no longer able to care for themselves. A Durable Power of Attorney allows your agent to act on your behalf even if you are not mentally capable. All Powers of Attorney cease upon death of the maker.

- Living Will / Advance Directive / Health Care Directive: These terms all refer to the legal document that lets you state your wishes for end-of-life medical care. For some clients, this is the most difficult document, but is extremely important. It’s your opportunity to specify what medical treatments you would want if you are unable to give informed consent. You’ll want to include whether you’ll want life-prolonging medical care, if you want to receive food and water, or prefer palliative care to interventional medicine. Additionally, it allows you to specify whether you want to be an organ and/or tissue donor.

- Designating Beneficiaries: You’ve named your heirs in your Will, but what about your life insurance policies and financial accounts, such as your IRA or 401k? This is where you’ll want to designate beneficiaries. They can be the same as your heirs, but don’t necessarily have to be. It’s important to note that designated beneficiaries generally need a copy of the death certificate to file a claim to receive the assets. Assets from life insurance or a retirement plan pass outside of your estate immediately upon presentation of a death certificate. If you don’t designate beneficiaries, assets may pass to your estate and require probate and or payment of estate taxes.

Review existing Estate Plans

You already have all these documents. Great. But, if it’s been a while since you’ve reviewed and made changes, and your life has changed — maybe a new child or grandchild, marriage, or divorce — it’s time to review your documents and see if you need to update any or all of them. We’re here to help you with that, too.

We do this all the time!

Our job is to counsel our clients and help them create a plan and legal documents that best fit their specific situations. We represent clients in Florida, New Jersey, and Hawaii. Call now 877.727.5379 to schedule a free initial consultation with our experienced estate planning and probate attorneys by phone or Zoom.