Mastering Estate Planning and Probate Law in Fort Lauderdale: Essential Guide by Attorney Jonathan H. Parker

Estate planning and probate law are critical areas of legal practice that ensure the orderly transfer of an individual’s assets upon their death. In Fort Lauderdale, Florida, these legal processes are governed by state statutes that aim to protect the interests of the decedent, their beneficiaries, and creditors. Understanding the intricacies of estate planning and probate law can help individuals make informed decisions to secure their legacy and provide for their loved ones.

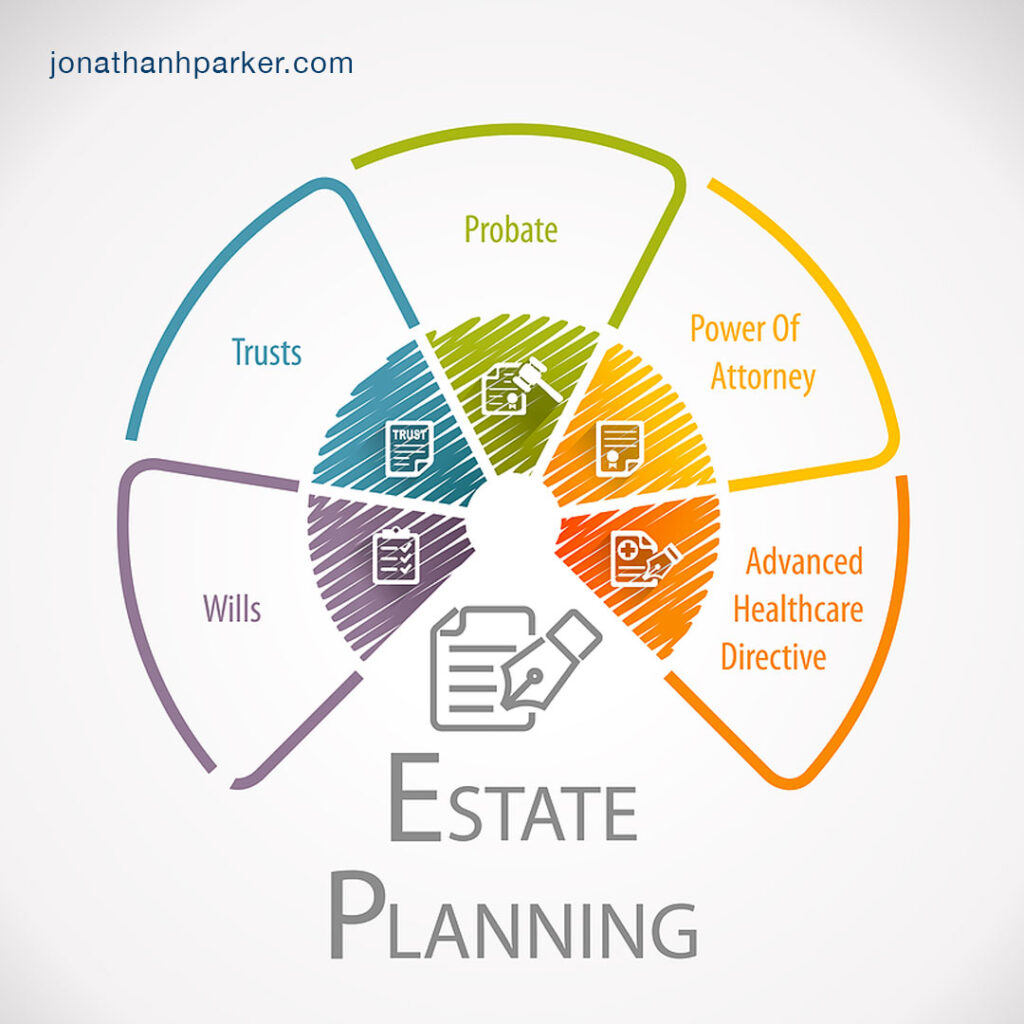

Estate Planning: The Foundation of a Secure Future

Estate planning involves creating a comprehensive plan to manage and distribute one’s assets during their lifetime and after death. In Fort Lauderdale, key components of an effective estate plan include:

1. Wills and Trusts: A will is a legal document that specifies how an individual’s assets should be distributed after their death. Trusts, on the other hand, are arrangements where a trustee holds and manages assets on behalf of beneficiaries. Trusts can be revocable or irrevocable and offer various benefits, including avoiding probate and reducing estate taxes.

2. Powers of Attorney: This legal document allows an individual to designate someone to make financial and medical decisions on their behalf if they become incapacitated. In Florida, durable powers of attorney remain effective even if the individual becomes incapacitated.

3. Healthcare Directives: Also known as living wills, healthcare directives outline an individual’s wishes regarding medical treatment and end-of-life care. These documents ensure that healthcare providers and family members honor the individual’s preferences.

4. Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow individuals to designate beneficiaries. These designations take precedence over wills and can streamline the asset transfer process.

Probate Law: Navigating the Legal Process After Death

Probate is the legal process of administering a deceased person’s estate, ensuring that debts are paid, and assets are distributed to beneficiaries. In Fort Lauderdale, probate proceedings are conducted in the Broward County Probate Court. The process typically involves the following steps:

1. Filing the Petition: The probate process begins when an interested party, usually the executor named in the will, files a petition with the court to open the estate.

2. Validating the Will: If there is a will, the court must validate it. This involves verifying that the will is legally sound and was executed according to Florida law.

3. Appointing the Personal Representative: The court appoints a personal representative (executor) to manage the estate. If there is no will or the named executor cannot serve, the court will appoint someone to this role.

4. Notifying Creditors and Beneficiaries: The personal representative must notify all creditors and beneficiaries of the estate. Creditors have a specific period to file claims against the estate.

5. Inventorying the Estate: The personal representative must compile an inventory of the estate’s assets, including real estate, bank accounts, investments, and personal property.

6. Paying Debts and Taxes: The personal representative is responsible for paying the deceased person’s debts and any applicable taxes from the estate’s assets.

7. Distributing Assets: Once all debts and taxes are paid, the remaining assets are distributed to the beneficiaries according to the will or Florida intestacy laws if there is no will.

Avoiding Probate: Strategies and Benefits

Many individuals seek to avoid probate to save time, reduce costs, and maintain privacy. Several strategies can help achieve this goal:

1. Revocable Living Trusts: Assets placed in a revocable living trust pass directly to beneficiaries without going through probate.

2. Joint Ownership: Holding property as joint tenants with rights of survivorship or as tenants by the entirety allows the property to pass directly to the surviving owner.

3. Beneficiary Designations: Designating beneficiaries on accounts and policies ensures that these assets bypass probate and go directly to the named individuals.

4. Payable-on-Death (POD) and Transfer-on-Death (TOD) Accounts: These designations on bank and investment accounts allow the assets to transfer directly to the beneficiaries upon the account holder’s death.

Conclusion

Estate planning and probate law in Fort Lauderdale, Florida, are essential for managing and transferring assets effectively. By understanding the legal requirements and employing strategies to avoid probate, individuals can ensure their wishes are honored, and their loved ones are provided for. At Parker & Maloney, P.A., we are dedicated to guiding clients through these complex processes, offering personalized solutions to meet their unique needs. Contact us today to secure your legacy and achieve peace of mind.

About the Author

Jonathan H. Parker is an experienced attorney at Parker & Maloney, P.A., specializing in estate planning, wills, trusts, and probate law. With a commitment to providing exceptional legal services, Jonathan helps clients navigate the complexities of these critical areas, ensuring their assets are protected and their wishes are fulfilled.